Emerging Technology (ET) has a big impact on the Finance Function and Financial Audit: while Finance is transitioning to business advisors and Financial Audit needs to drive quality, efficiency and added value, the bets on innovation with ET are huge. Data driven audit, Artificial Intelligence (AI), Robotic Process Automation (RPA) and intelligent forecasting are at the top of the buzz of financial and audit technology change. Drones and augmented reality are shining at the horizon. However, what is the current status of ET in the audit, the impact on how audits are carried out and how Finance and auditors interact?

Clients are no longer looking for just a rear-view mirror, but a view through the windshield on where we are going and how to navigate the landscape of risks, opportunities, changing regulation, competition and globalization.

As one of the typically more progressive regulators, the Financial Reporting Council (FRC), the UK’s audit regulator, interviewed audit committee chairs and investors about auditors’ use of technology («The use of technology in the audit of financial statements», Financial Reporting Council, March 2020). The report found that audit committee chairs: “…expect auditors to be “bold enough to expand procedures” using automated tools and techniques to go beyond a historical-looking audit.” Similarly, that investors “welcome the use of technology to drive audit efficiencies and audit quality. They perceive benefits from assessing entire populations of transactions, providing “greater assurance to shareholders”.

Rather than changing the rules in order to achieve the above, some regulators are delivering practical guidance to the market around technologies used in the audit. This aligns with their long-standing view that auditing standards should remain principles based. The result of this – together with general advances in technology – are that organizations should expect technology to feature more prominently in discussions with their auditors.

Centralizing and standardizing to reflect business structures

Auditors have a wealth of industry experience in navigating the landscape of risks. As technology drives transformation, more often, we are accompanying our clients through their change, inspiring them to make the best out of their IT investments to manage risk. We also seek to structure our audit to mirror a client’s organization and leverage technology and data advancements. This includes centralizing, standardizing and modernizing audit efforts to reflect the business trend over the past decade to bring activities together in national or multinational shared-service centers, centers of excellence and capability hubs.

These efforts are facilitated by technology, and we collaborate with external partners to develop the skills involved in using automated auditing tools and techniques, as well as leveraging subject-matter experts with true cross-border roles to scale quality and efficiency.

The benefits to our clients are clear. Increasing degrees of centralization and standardization, amongst other benefits, promotes quality and process efficiency. In addition, it results in a better audit experience by causing less surprises and disruption to local management teams. At the same time, our audit talent pool deepens, allowing us to bring new data-driven perspectives and insights to our clients.

Leveraging clients’ investments in technology

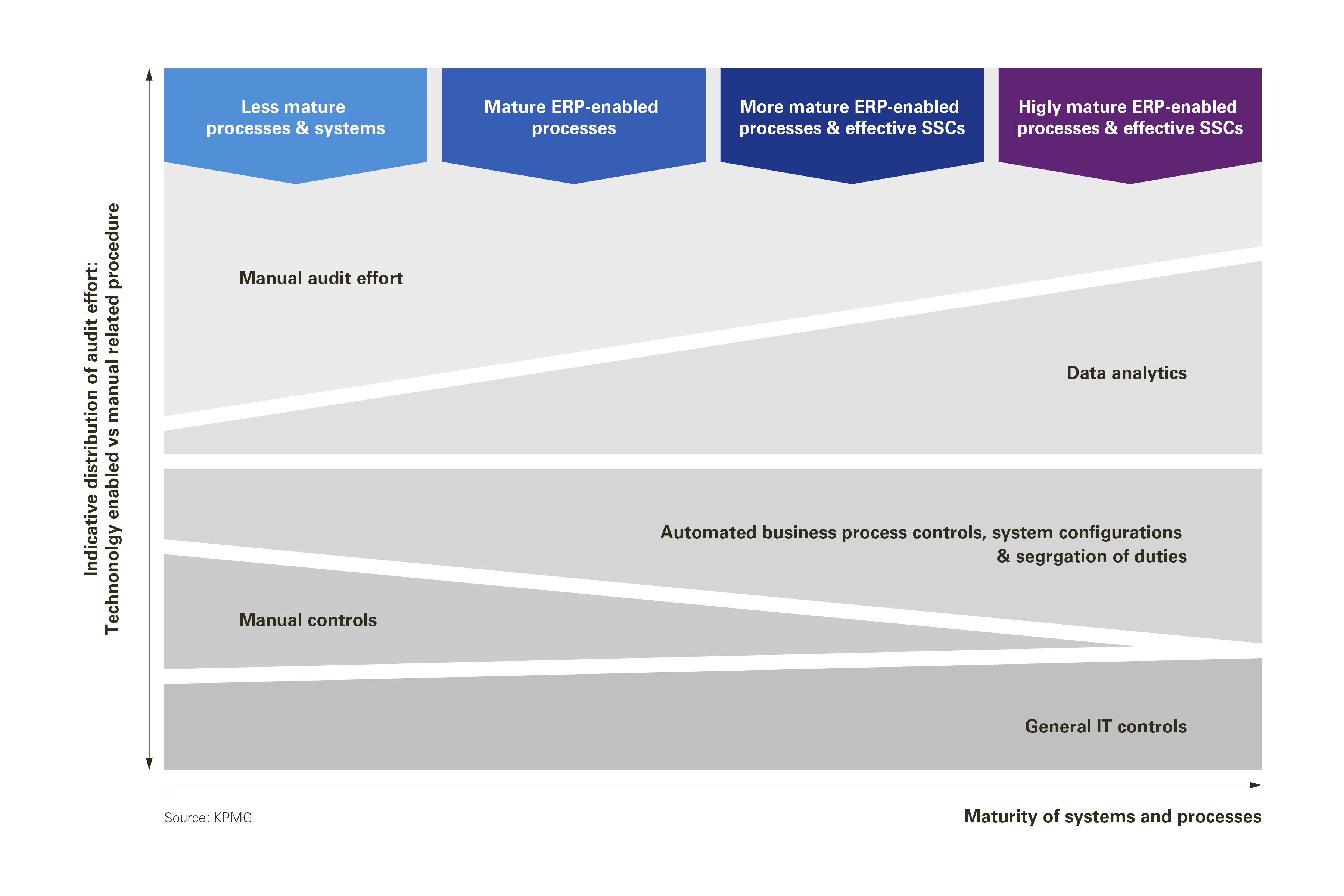

Auditors rely heavily on the sophistication of clients’ own IT landscapes when determining the extent to which we can deploy technology solutions effectively on a given audit. This reliance will increase into the future as ET is industrialized. In principle, the more mature, standardized and harmonized a client’s IT landscape and processes, the easier it is to deploy a sophisticated data-driven audit approach.

The way KPMG continually invested and challenged themselves so that their audit evolved at the pace of our own transformation has been remarkable… harnessing the power of new technologies when and where they made sense… ensured a robust and efficient audit, directing the audit effort to the right place and ensuring that Nestlé's investments in standardization and centralization were fully leveraged.

Modern Enterprise Resource Planning (ERP) systems, combined with RPA and low-code satellite platforms, for instance, allow businesses to implement standardized and highly automated processes that connect multiple departments, locations and functions. The standardized data trail created by these processes enables the Financial Function to apply advanced analytics and monitoring, thus becoming a mature business partner. It also enables us to modernize and use data in every step of the audit.

At KPMG, for example, we have developed specific solutions to leverage this potential – from risk assessment where we use data to better understand processes and spot unusual trends with KPMG Clara Business Process Mining, to audit response where we derive substantive audit evidence through targeted general-ledger and sub-ledger analytics procedures with KPMG Clara Analytics to focus on risks that really matter.

As technology continues to advance, auditors must be able to offer an extensive toolbox of solutions to meet all client situations. The sustainable success of many audit firms will be determined by their ability to federate innovation to build an ecosystem of innovative technology-based audit tools that can be brought together in an integrated and connected yet governed way.

Blending audit methodology with the latest technologies, client data and interactions in a considered and intuitive way will become critical. This is why our approach is delivered through our global KPMG Clara Platform, which integrates evolving technologies in a powerful yet agile way.

Using automation to enhance quality and effectiveness

As the ensemble of data driven tools and techniques continue to harmonize, it will challenge existing audit methodologies and improve audit quality. Historically, risk assessment, controls testing, and substantive testing have largely been targeted in isolation. Now, auditors can use technology to interrogate transactional data to provide evidence over all three areas at once. KPMG Clara is an obvious reflection of this, with clients’ structured financial data driving analytics regarding risk assessment, automatically populating audit workpapers, and generating substantive analytics, simultaneously.

As well as continuing to replace simple, repetitive, and high manual effort tasks such as sampling and general ledger analytics, automation is rapidly extending into judgmental audit areas. New tools and techniques are increasingly able to accommodate more challenging, unstructured data sets. KPMG’s Intelligent Platform for Automation (IPA) captures many of these new tools, in a governed platform, including making RPA available to support in various areas of the audit. These RPA’s include, for example, cognitive techniques to support review and annotate client documents, bringing Journal Entry testing to the next level with advanced AI driven outlier detection, and automating the preparing of working papers with cognitive circling and highlighting techniques.

Also, within our audit client portfolio, the first AI applications have arrived in the scope of the financial audit. To help our clients navigate the new challenges brought by AI, KPMG has developed an AI in Control framework that is applied when AI needs to be audited. This framework also anticipates EU and Swiss regulations for AI, which we expect will be released soon.

Predictive forecasting, AI and machine learning are complementing human insight and starting to deliver more robust assurance. This approach gives clients higher quality and peace of mind, secure in the knowledge that the technologies and interrogation techniques deployed on their audit will bring fresh perspectives to risk. A clear example of this is our use of KPMG Clara Contract Management module to synchronize Optical Character Recognition (OCR) technology with sophisticated algorithms to interpret less-structured data and determine if accounting classifications are compliant with auditing standards. Likewise, challenging management’s impairment assumptions with KPMG Clara’s Asset Impairment Tool (CAIT), to assess sensitivities and calculate the probability of impairment based on historical forecasting accuracy, is paving the way for more sophisticated technologies in the audit.

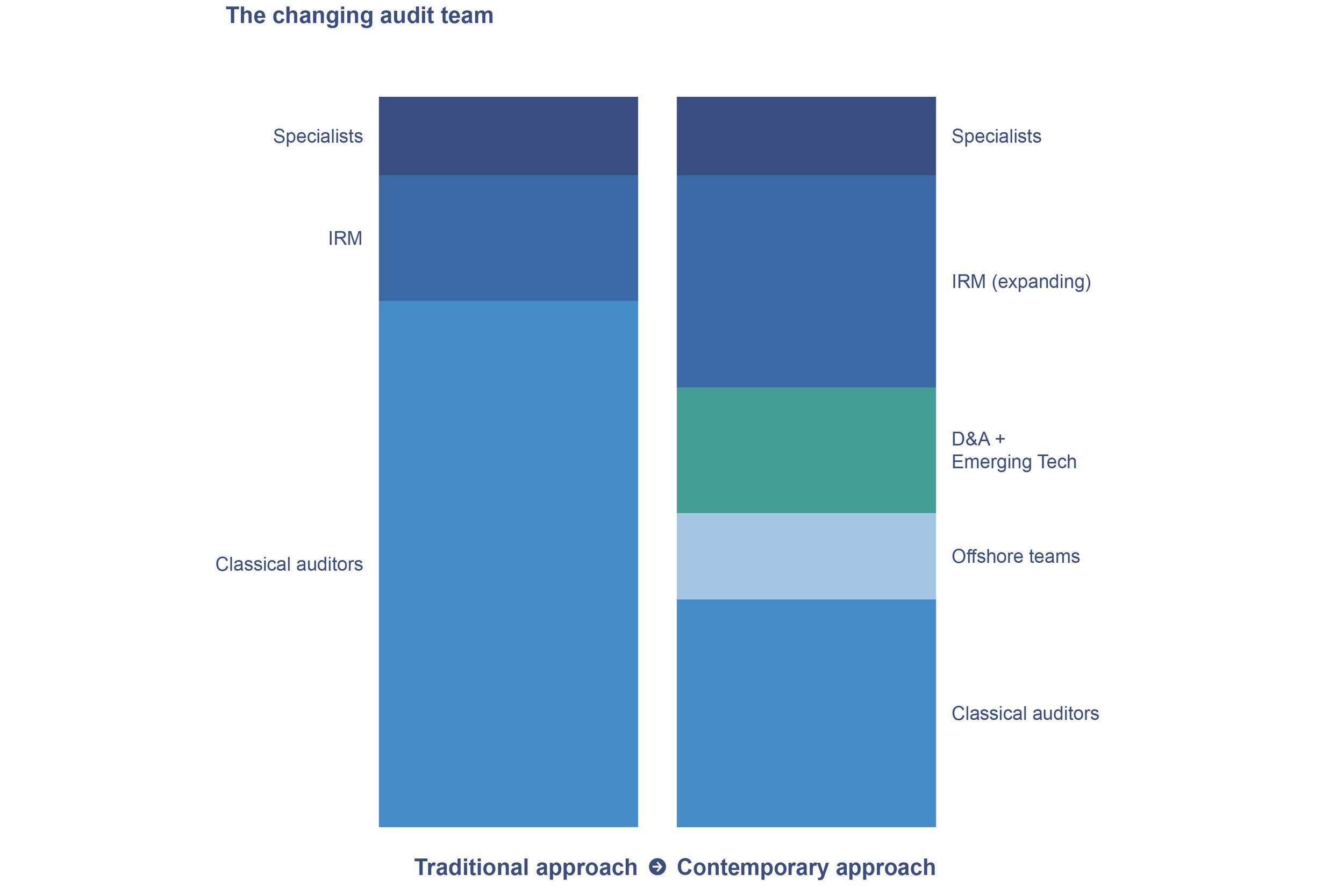

Evolving the profile of a typical audit team

All of these technology opportunities and changes have implications for an audit team’s composition. Classical audit foundations will still be required to opine on financials, but there is also a need to be proficient in the use of data analytics, automation and emerging technologies. Auditors, just like Finance departments, must now adopt a data scientist’s thinking to deal with data and big and unstructured data sets. As technology and automation continue to change auditors’ day-to-day roles, clients will see benefits through access to a broader knowledge pool, new data-driven perspectives, and a deeper understanding of technology risk. Firms will continue to blend specialist roles with traditional audit roles by integrating data analytics and ET into the audit function. In short, the look of a typical audit team will change.

Anticipating the audit of the future

Some visionary people foretell a complete replacement of the Finance Function and Financial Audit. We can`t look into a crystal ball, but if it will get that far, it will take a while. For the moment, technology will not entirely replace the human perspective, especially in areas of judgment. Technology and human expertise will advance in unison, reinforcing and pulling each other along. Because audit is, and will continue to be, a people profession that is enhanced by technology.

New technologies and data driven focus will help us build innovative tools that come together in an increasingly integrated way. As auditors, we will have more time to focus on risk that matters, and more complex and judgmental areas. Data-driven techniques will meanwhile enable quicker assurance over routine and frequent transactions, and we will move from auditing largely historical information, towards continuous monitoring that feeds real-time decision making.

Benefiting both auditors and our clients, technology will help us deliver even deeper insights that support businesses’ forward-looking perspectives, thereby also fulfilling the growing expectations of regulators and society at large and adding even greater value to our clients. KPMG welcomes this change.

Connect with us

We want to help answer questions. Questions that are currently being asked and questions that may not arise for several days or weeks. Please do not hesitate to contact us – our experts are ready to support you with advice and assistance.

Clarity on the Future of Audit

Leveraging the potential of advanced technologies and new ways of working to shape the future of audit.

Clarity on Emerging Technologies

Shaping the future.

KPMG Clara

KPMG Clara is the beginning of a new era for the audit – a gateway into the digital future.

KPMG Lighthouse

Our Center of Excellence for data-driven technology.